In our recent article "Why YouTube buffers: The secret deals that make—and break—online video," we described how battles between ISPs and streaming video providers can have a dramatic impact on video quality in customers' homes.

The chief issues? ISPs refusing to upgrade peering connections to relieve congestion and ISPs refusing to take YouTube owner Google and Netflix up on their offers of free caching equipment that puts video content closer to the last mile. To a cynical eye, it looks like ISPs either want money from Google and Netflix or want to degrade Google and Netflix quality to drive users to their own services.

But there are exceptions, mostly among small ISPs. RCN, a regional provider in Chicago, Boston, New York, Washington, DC, and parts of Pennsylvania, took Netflix up on its offer (called Open Connect), and its decision is justified by the data. Netflix has published its first regional speed index, just for the Boston area, and it showed that "the average speeds for Netflix streams on the RCN network in Boston outperformed other Internet Service Providers (ISPs) by as much as 70 percent. This means that those Netflix members who were also RCN customers enjoyed better picture quality, quicker access to their favorite TV shows and movies, and more reliable playback delivered via the Internet from Netflix, especially during peak viewing hours."

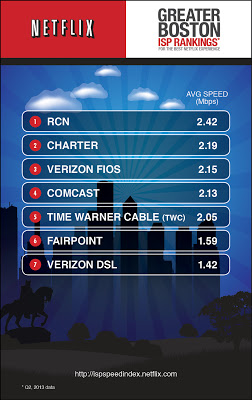

In the second quarter, RCN's cable service out-performed Charter, Verizon FiOS, Comcast, Time Warner Cable, Fairpoint, and Verizon DSL. None of the companies RCN beat are publicly known to be Open Connect users. Time Warner in particular has made it known that it wants nothing to do with Netflix's caching service.

This regional chart is a follow-up to the national rankings, in which Google Fiber and CableVision (two Open Connect users) top the list.

The data is validation for Netflix—but of course the company has self-interest at play here and may be doing some cherry-picking to portray Open Connect in the most favorable light. The rankings are based on real-world data, the average of all Netflix streams. But Netflix could choose to publish data only in regions that highlight Open Connect's successes and minimize its failures, if it were so inclined.

"We expect to publish more regional snapshots in the future and we'll highlight certain markets to showcase where ISPs are delivering a great Netflix experience to consumers," Netflix said. "Often these ISPs don't meet the criteria for our national rankings, so we have a chance to show off their performance in these regional snapshots."

The Boston rankings are the only regional snapshot we've seen so far. Also, the national rankings don't show a perfect correlation between Open Connect use and high quality. Frontier is an Open Connect user but lies near the bottom of Netflix's nationwide rankings (although that may be because it is mostly serving rural areas and small communities where building out infrastructure is expensive on a per-home basis).

Despite those caveats, we're comfortable in saying that customers are likely to get better service when ISPs and video providers work together instead of fighting over money.

reader comments

105